AI agents in financial forecasting 2026 are set to flip the script on how CFOs and finance teams predict the future, turning clunky spreadsheets into dynamic, self-thinking powerhouses. Imagine your forecasting tool not just crunching numbers but actually anticipating market shifts, adjusting budgets on the fly, and even negotiating vendor terms—all without you lifting a finger. That’s the magic unfolding right now, and if you’re in finance, ignoring it could leave you playing catch-up in a world that’s moving at warp speed.

I’ve been digging into this trend, chatting with industry folks and poring over reports from giants like PwC and Deloitte, and let me tell you—it’s game-changing. In 2026, AI agents aren’t some sci-fi dream; they’re practical allies boosting accuracy by up to 40% and slashing forecasting time dramatically. But how do we get there? Let’s break it down, step by step, so you can see why AI agents in financial forecasting 2026 is the hottest topic for forward-thinking leaders.

Understanding AI Agents: The Brain Behind Smarter Forecasts

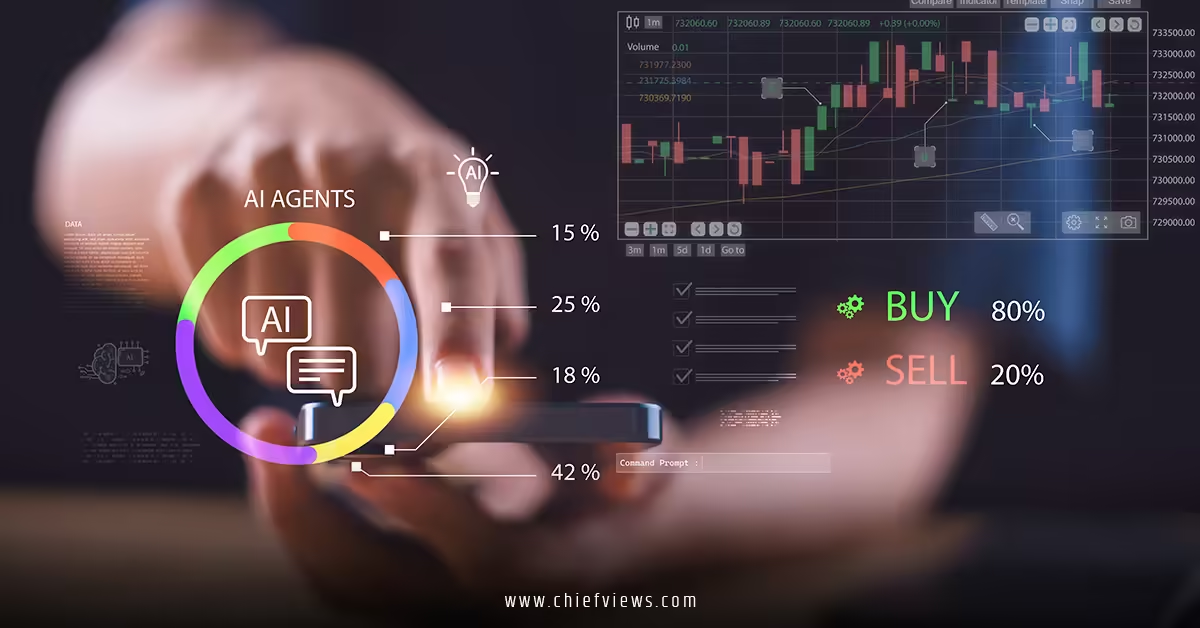

What exactly are these AI agents everyone’s buzzing about? Think of them as super-smart assistants that don’t just follow orders—they think, plan, and act independently. Unlike traditional AI that might analyze data in isolation, agents in 2026 are “agentic,” meaning they handle multi-step tasks autonomously. For financial forecasting, that could mean pulling real-time data from markets, simulating scenarios, and tweaking predictions based on emerging trends.

Picture a busy CFO juggling quarterly reports. Instead of manually sifting through ERP systems and market feeds, an AI agent dives in, models cash flows with live data, and flags variances before they blow up. Gartner predicts that by the end of 2026, 40% of enterprise apps will feature these task-specific agents, up from less than 5% in 2025. It’s like upgrading from a bicycle to a self-driving car—faster, safer, and way more efficient.

Why does this matter for AI agents in financial forecasting 2026? Because volatility is the new normal. Geopolitical tensions, supply chain hiccups, and economic swings demand forecasts that adapt in real time. Agents make that possible by integrating diverse data sources—think internal financials, external market signals, even social sentiment—and delivering insights that humans alone might miss.

The Evolution of Financial Forecasting: From Static to Dynamic

Remember when forecasting meant plugging numbers into Excel and hoping for the best? Those days are dinosaurs. In 2026, AI agents in financial forecasting 2026 evolve the game by turning static models into living, breathing systems.

How AI Agents Supercharge Accuracy and Speed

One killer feature? Predictive modeling on steroids. Agents use machine learning to analyze vast datasets, spotting patterns that escape the human eye. PwC notes that AI can improve forecasting accuracy and speed by up to 40% when deployed effectively. Rhetorical question: Wouldn’t you love forecasts that adjust automatically to a sudden tariff change or consumer trend shift?

Take liquidity optimization as an analogy—it’s like a GPS rerouting you around traffic. Agents continuously model cash flows, incorporating live ERP and market data, to keep your finances nimble. Deloitte’s surveys show 87% of CFOs see AI as extremely important to finance ops in 2026, with agents leading the charge in transforming workflows.

Integrating Multi-Source Data for Holistic Views

Agents don’t work in silos. They pull from everywhere: sales pipelines, production metrics, even weather data if it impacts supply chains. This holistic approach reduces blind spots. For instance, in manufacturing, agents merge production and sales streams for pinpoint variance analysis. It’s bursty—sudden insights pop up, keeping your team ahead.

But here’s a twist: these agents learn over time. Feed them historical data, and they refine predictions, turning “good enough” into “spot-on.” In 2026, expect agents to handle 60% of routine finance tasks, freeing humans for strategic plays.

Key Trends Driving AI Agents in Financial Forecasting 2026

The landscape is shifting fast. Let’s zoom in on the trends making AI agents in financial forecasting 2026 a must-know.

Agentic AI: From Assistants to Autonomous Workers

Agentic AI is the buzzword. These aren’t chatbots; they’re doers. PwC’s 2026 predictions highlight agents automating complex workflows like demand sensing and scenario planning. In finance, that means agents reconciling accounts, detecting anomalies, and even forecasting revenue with minimal oversight.

Google Cloud’s report on financial services trends points to “agents for every workflow,” empowering peak productivity. Imagine an agent orchestrating your entire FP&A process—it’s not far-fetched; 44% of finance teams will use agentic AI this year.

Human + Agent Workflows: The Power Duo

No, agents won’t replace you—they’ll amplify you. Lucanet describes “Human + Agent” setups where agents handle data drudgery, letting teams focus on decisions. Deloitte echoes this, with 54% of CFOs prioritizing AI agent integration for 2026.

Analogy: It’s like having a co-pilot in a race car. You steer strategy; the agent handles the nitty-gritty, boosting overall speed.

Regulatory and Ethical Considerations in Forecasting

With great power comes responsibility. Agents must comply with regs like GDPR or SEC rules. PwC stresses responsible AI, with transparency and explainability key. In forecasting, this means auditable predictions—no black boxes.

Trends show AI-powered RegTech rising, ensuring forecasts are compliant and bias-free.

Real-World Applications: AI Agents in Action for 2026

Let’s get practical. How are AI agents in financial forecasting 2026 playing out?

Case Study: Manufacturing Forecasting Overhaul

One manufacturing firm used agents to blend production and sales data, achieving sharper forecasts and faster analysis. Result? Reduced variances and millions saved.

Banking and Wealth Management Wins

In banking, agents forecast fraud risks and personalize advice. Citi outlines agents in wealth management for forecasting and more. Accenture predicts 57% of banks using agents in risk and audit by 2029, but 2026 is the ramp-up.

FP&A Reimagined

Wolters Kluwer sees FP&A shifting as agents take routine work, expanding decision support. Infosys BPM notes AI enhancing forecasts with continuous data analysis.

Linking back, this ties into broader CFO strategies. For deeper insights on securing these tools, explore our piece on CFO Leadership in Cybersecurity and Financial Agility 2026.

Challenges and How to Overcome Them in AI Agents in Financial Forecasting 2026

Not all smooth sailing. Hurdles like data privacy, integration costs, and skill gaps loom.

Tackling Data Quality and Integration

Garbage in, garbage out. Agents need clean data. Solution? Invest in governance—PwC says it cuts risks by 35%.

Building the Right Skills

Finance teams need upskilling. Deloitte flags AI skills as top priority for 2026. Start with training; make it beginner-friendly.

Measuring ROI

Skeptical CEOs? Show the money. Gartner notes AI spending hits trillions, but ROI scrutiny rises. Track metrics like forecast accuracy gains.

Strategies to Implement AI Agents in Financial Forecasting 2026

Ready to dive in? Here’s your playbook.

Start Small, Scale Smart

Pilot one agent for cash flow forecasting. Measure, iterate.

Choose the Right Tools

Look for platforms with built-in agents, like those from Dataiku for agentic systems.

Foster Collaboration

Team up with IT and data pros. Human oversight ensures ethical use.

Stay Ahead of Trends

Monitor reports—Grand View Research sees the AI agents market in finance growing to $6.7B by 2033.

The Future Beyond 2026: Where AI Agents Take Us

By 2027, agents could orchestrate entire finance functions. Deloitte predicts 50% of GenAI users piloting agentic AI. It’s exciting—more agility, less drudgery.

In essence, AI agents in financial forecasting 2026 empower you to predict and shape the future. Don’t wait; start experimenting today.

Conclusion

AI agents in financial forecasting 2026 mark a pivotal shift, blending autonomy with precision to redefine finance. From boosting accuracy by 40% to enabling real-time adaptations, these tools empower CFOs to lead with confidence amid uncertainty. Embrace them now—collaborate, upskill, and integrate—to turn challenges into opportunities. The finance world is evolving; position yourself at the forefront for sustained success and innovation.

FAQs on AI Agents in Financial Forecasting 2026

1. What role do AI agents play in financial forecasting for 2026?

AI agents in financial forecasting 2026 autonomously handle multi-step tasks like data integration and scenario modeling, improving accuracy and speed by up to 40% as per industry reports.

2. How can businesses implement AI agents in financial forecasting 2026 effectively?

Start with pilots focused on cash flow or revenue predictions. Ensure data quality and team training to maximize the benefits of AI agents in financial forecasting 2026.

3. What are the main benefits of using AI agents in financial forecasting 2026?

They offer real-time adjustments, reduce manual errors, and free up teams for strategic work, making AI agents in financial forecasting 2026 essential for agile finance operations.

4. Are there risks associated with AI agents in financial forecasting 2026?

Yes, like data privacy and integration challenges. Mitigate them through strong governance and ethical AI practices when deploying AI agents in financial forecasting 2026.

5. How do AI agents in financial forecasting 2026 tie into broader CFO strategies?

They enhance agility and decision-making, complementing areas like cybersecurity. For related insights, see our article on CFO leadership in cybersecurity and financial agility 2026.